Search for information

UK Stocks Surge for 12 Consecutive Days, Led by Financial Sector, Cryptocurrency Regulation LaunchedThe UK stock market has witnessed an impressive rally recently. On April 29th, the FTSE 100 index rose 0.6%, achieving a 12 - day winning streak, the longest in five years. Meanwhile, the mid - cap index has climbed for five consecutive days. The financial sector, which saw a 1.9% increase, was the main driver of this upward trend. HSBC Holdings, with a 2.6% gain, led the blue - chips. It benefited from its better - than - expected Q1 profits and a $3 - billion share - buyback plan.

May 13, 2025, 1:52 pm EDT

Source: Images from the Internet, if there is any infringement, please contact the removal of

Large - scale Seizure of Illegal E - cigarettes at Saint - Ouen Flea Market in France

Large - scale Seizure of Illegal E - cigarettes at Saint - Ouen Flea Market in Francemore

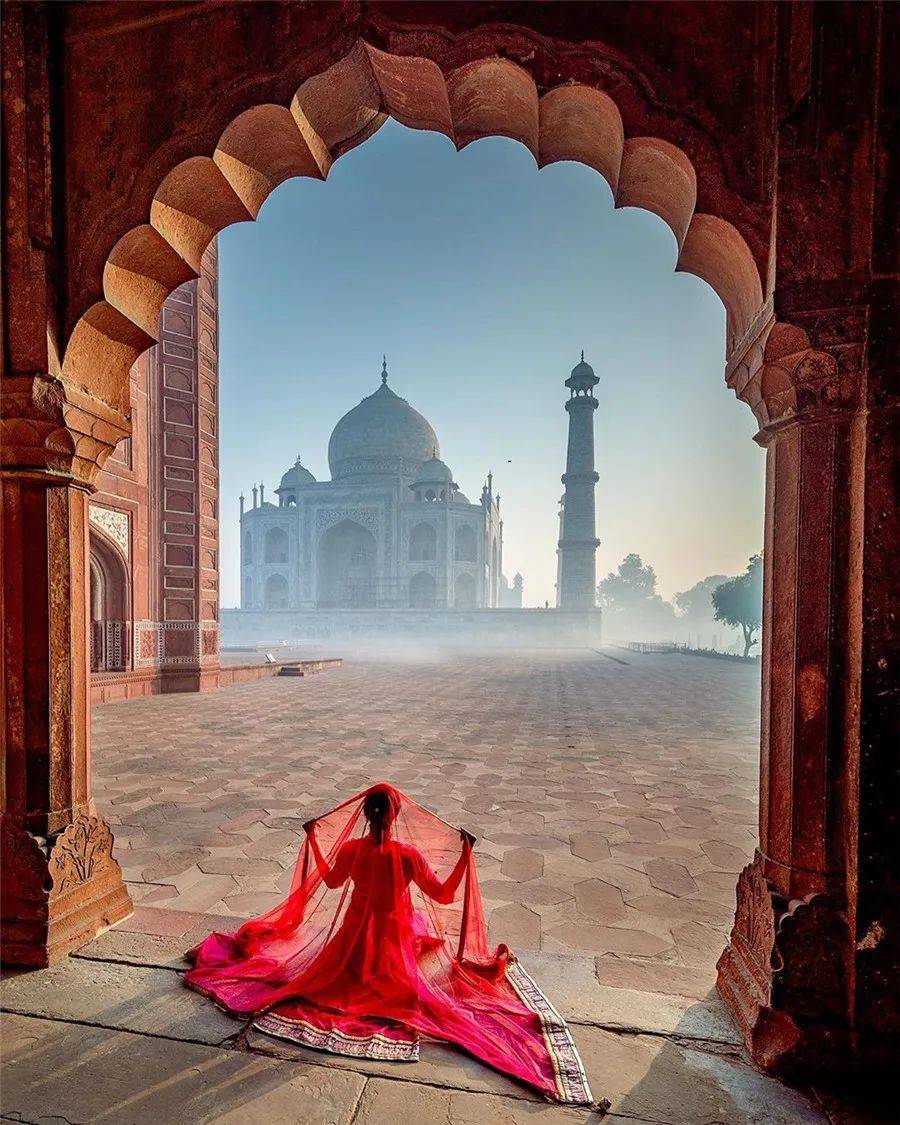

An eye-opening view of the world's wonders and beauties(1)

An eye-opening view of the world's wonders and beautiesmore

A stellar lineup of international models redefines beauty standards through the lens of artistry!more

Australian Stocks Surge 0.92% to Top 8000, with Uranium Shares Leading the Way

On April 29, the S&P/ASX 200 index in Australia witnessed a significant upswing. It climbed 73.5 points, or 0.92%, to close at 8070.6 points, hitting a new eight - week high. The market sentiment received a boost from the 利好 news of the United States reducing tariffs on auto parts.more

Candlelight gilds collarbone valleys, silk drapery encrypts rococo mysteries. Renaissance brushstrokes reawaken in 4K clarity upon living marble.more

Backpack-like games enter Top 100 games in many countries

Backpack-like games enter Top 100 games in many countriesmore

The Enchanting Towns of Southern France: More Alluring Than Paris

In France, Paris often comes to mind as the first impression when people think of the country. The Eiffel Tower and the Louvre Museum attract countless tourists. However, the true soul of France is hidden in the ancient and charming towns of southern France. The towns in southern France seem to emerge from a fairy tale, peaceful and beautiful, standing alone in the world, becoming a unique and distinctive landscape in France, captivating countless people.more