Search for information

UK Economy Shows Mixed Signals: Ebbing Housing Policy and Pressured ManufacturingThe UK economy is displaying divergent signals, with the housing market and manufacturing sector showing contrasting trends. In March, mortgage lending in the UK increased by £12.963 billion, reaching a new high since June 2021. This was driven by homebuyers rushing to take advantage of the first - time buyer tax - break before it ended on April 1st. However, the housing market cooled rapidly after the policy ended.

May 13, 2025, 2:30 pm EDT

Source: Images from the Internet, if there is any infringement, please contact the removal of

The ultra-clear version of world scenery offers an incredibly stunning visual experience! Although we don't have wings and can't overlook the world like birds in the sky, with the help of aerial photography technology, we can appreciate the magnificent landscapes around the world.more

Innovative or Dangerous? Palestinian Barbers’ Fiery Haircuts

In Palestine, a rather unconventional and attention - grabbing hair - cutting method has emerged: using fire to style hair. This practice, though seemingly extreme, has found its place in some local barbershops, sparking both curiosity and concern.more

In Thailand, Wearing Underwear Outside Is a Must

In Thailand, a country known for its vibrant culture and beautiful landscapes, there's an unusual yet strictly enforced law that might catch travelers off guard: leaving your residence without wearing underwear is illegal. This regulation, which may seem quirky to outsiders, is taken seriously by the local authorities.more

A Potential Record in the Number of Participating Teams as a Prestigious Football Tournament Approac

A Potential Record in the Number of Participating Teams as a Prestigious Football Tournament Approaches Its Centenarymore

Explore the stunning scenery of New Zealand's North and South Islands

Explore the stunning scenery of New Zealand's North and South Islandsmore

Bullfighting: A Deep - Rooted Passion in Spain

Bullfighting, or "corrida de toros," stands as an enduring symbol of Spanish culture, deeply ingrained in the nation's identity and passionately cherished by many Spaniards. This age - old spectacle combines elements of art, bravery, and tradition, captivating audiences across the country for centuries.more

Esports World Cup 2025 Returns to Saudi Arabia with Record-Breaking Prize Pool

Esports World Cup 2025 Returns to Saudi Arabia with Record-Breaking Prize Poolmore

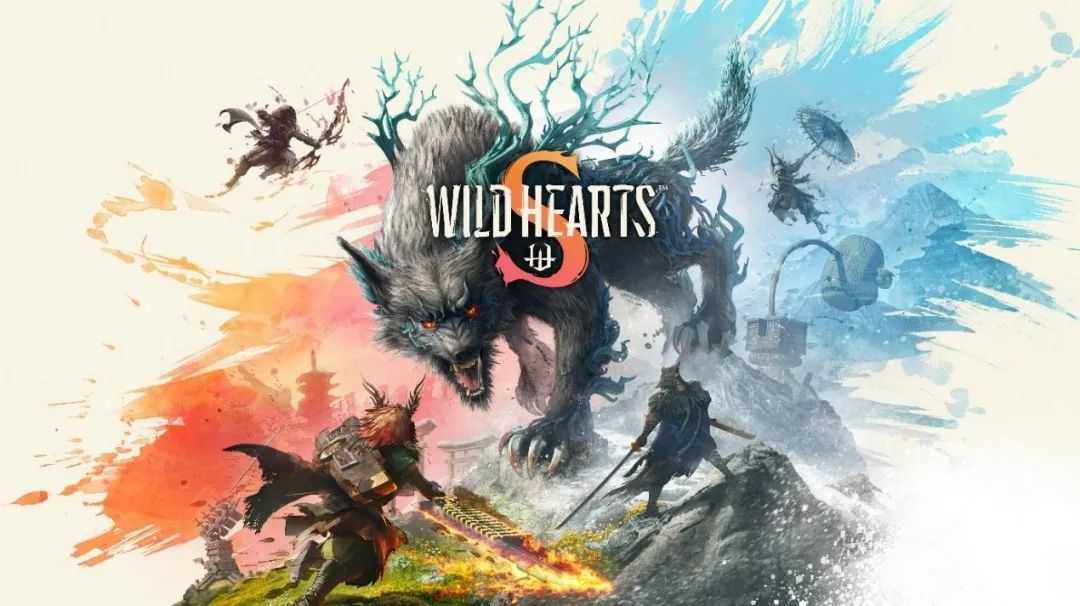

"Wild Hearts S" Heading to Nintendo Switch 2 on July 25

Koei Tecmo Taiwan has announced that the hunting action game "Wild Hearts S" for the Nintendo Switch 2 is scheduled to be released on July 25, 2025. Alongside this announcement, the company also unveiled a promotional video introducing the game.more